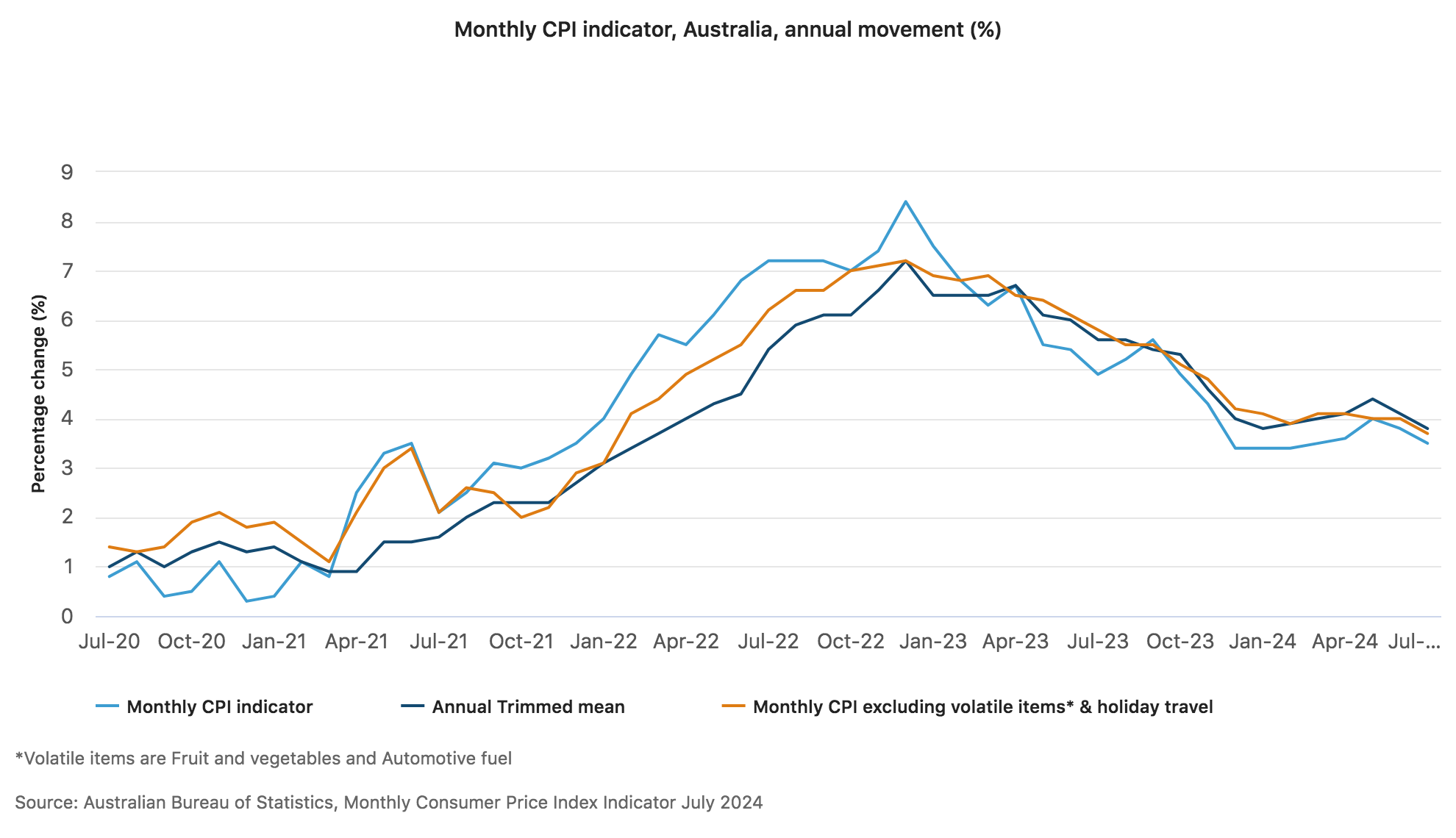

As we move into the busiest time in the real estate market the good news is buyers are showing renewed positivity. Inflation is cooling, the US Fed Reserve is poised to cut rates which which should see the RBA following suit in early 2025.

The pace of interest rate cuts will depend on local data, but a downard trajectory has emerged. Some lenders including CBA have started cutting rates ahead of the RBA.

We have seen National capital city prices show a combined growth of approximately 7% this year, however the market in Melbourne has been far more subdued.

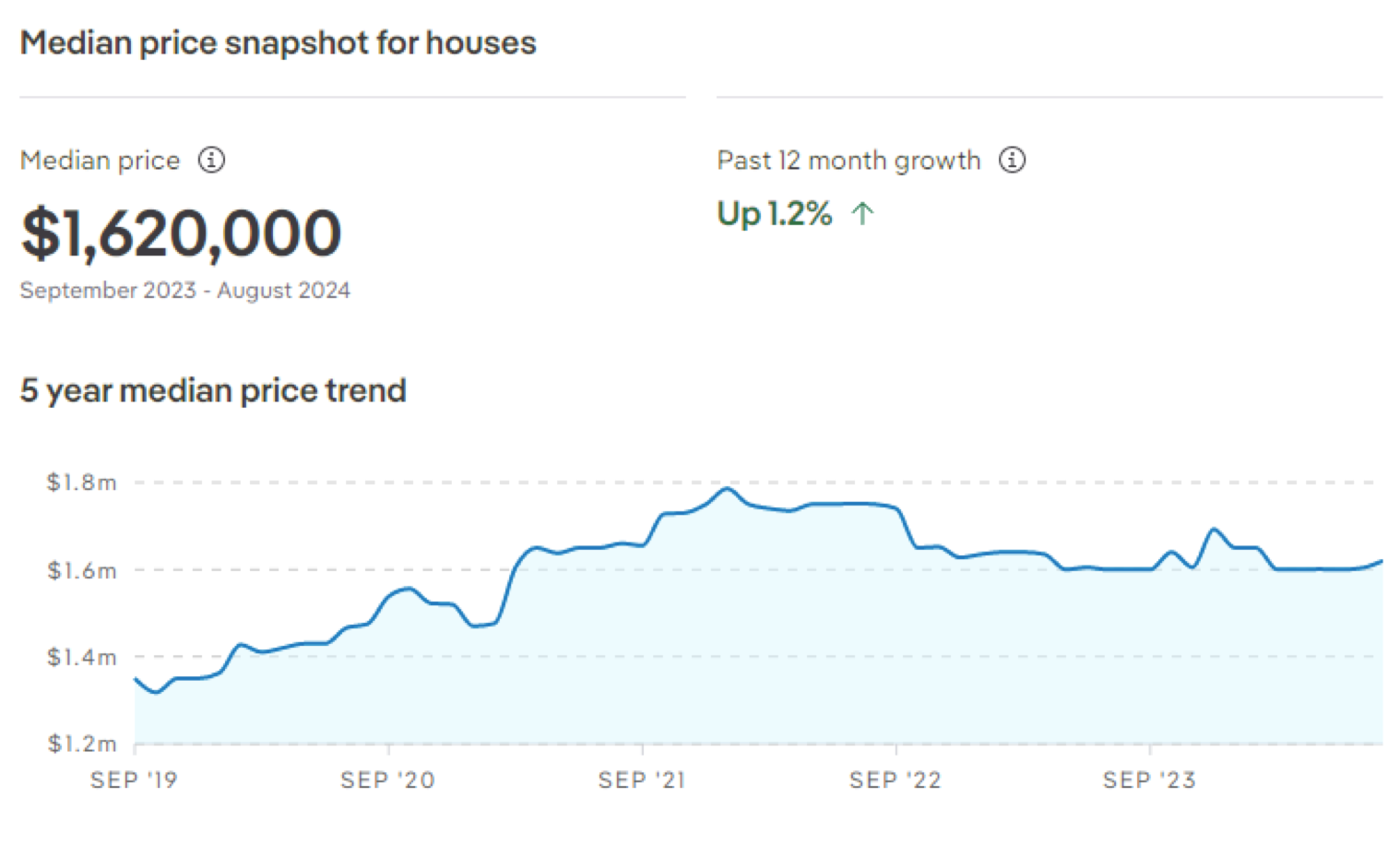

Local Port Melbourne house prices grew 1.2% outpacing Melbourne’s growth particularly our units which added 10% to the median apartment price. (REA).

If you’re thinking about buying or selling timing is important

Having sold 7 properties in 7 weeks, we’re experiencing stronger enquiry as a more competitive market emerges. Rather than sitting on the sidelines, buyers understand that its better to secure a new home rather than having to play tug-of-war with competitors once the interest rates start to come down.

The property cycle will move on as mortgage rates fall and we expect both supply and demand to increase coinciding with Spring and an increase in confidence. Bayside is at its best over Spring and Summer and we expect buyers and sellers to come out in full force.

Spring Into Action

We’re currently conducting appraisals and locking in Auction dates. There’s also plenty going on behind the scenes as we help our vendors get their properties ready. If you’re thinking of selling, we invite you to get in touch and we can step you through the selling process and help you prepare for sale. The starting point is an accurate appraisal and an expert recommendation of a cost-effective marketing campaign. We’ve got a fantastic buyer database ready to go, which puts buyers and sellers in a strong position to make a move.

Determining the value of a property became increasingly difficult coming out of covid. Even the most experienced real estate agents were being blamed for underquoting.

This reflected a limited supply of housing, near zero interest rates and the changing demand for specific property classes. Turnkey properties outperformed renovator opportunities due to skyrocketing building costs. We’re seeing many investors selling apartments which are being bought by home buyers due to their affordability and the increasing cost of renting. We’re not surprised that apartment prices have moved up much faster than houses last year.

In this dynamic market it is most important to seek reliable advice from an experienced agent who can accurately appraise your property.

We are proud to announce that Frank Callaghan AREI, CEA (REIV) Has received recognition from the President of the REIV for 50 years membership with the Real Estate Institute of Victoria and contribution to the community.

With 50 years experience in real estate we’re going strong. We know the Port Melbourne market, we know its buyers, we know its sellers and we know how to bring them together to achieve positive outcomes despite ever changing market conditions.

If you have any questions about the property market and how it impacts you, call our team for an expert consultation and complimentary appraisal.

Thank you for your time and we hope this has been helpful,