Date: 12th October 2020

It’s the question on everyone’s lips, now that Melbourne’s COVID cases are dwindling and inspections have returned, what does the real estate market look like and has the value of my property changed?

First of all, the advice in this article is general in nature. For a tailored property report and strategy, click here.

Melbourne Real Estate in a post lockdown world

Well, it’s all positive signs ahead for Melbourne as we head towards the Spring Rush. With the return of private inspections last week we have seen a rush of both vendors and buyers coming forward.

High Demand from frustrated buyers

Melbourne buyers in have spent the last few months, cooped up at home, planning for their next move. They’re frustrated and they’re raring to go. The only question that remains is, is the stock there to supply the demand?

Looking at online demand, online search on realestate.com.au is up 25% year on year while engagement with 3D tours has increased by 295% and video views by 52%.

Right now, interest rates are the lowest they have ever been, there is pent-up buying demand, and strong economic stimulus cushioning job losses. In our view, residential property will rebound strongly as restrictions ease, unleashing pent-up demand. Some vendors will wait to see how the sales campaigns go however they will not be rewarded as much as those who go first. There is a key advantage in going early, selling while stock remains low and before conditions potentially worsen as the economic stimulus is wound back.

If you’re a property owner looking to optimise your return in the next two years, then you may be better to move sooner than later. The banks’ mortgage freeze is expected to end in January 2021 and Job Keeper wound back. Credit, while cheap, is becoming harder to obtain. The effective unemployment rate is expected to rise above 10% causing hardship, simultaneously reducing the number of buyers in the market and increasing the number of properties on the market.

A look at residential values

Looking Nationally, September marked a striking turn in housing market sentiment; consumer confidence increased, new listings rose, and six of the eight capital cities recorded a rise in home values over the month.

The two most affected states Melbourne and Sydney continue to report falling values. Looking at Melbourne specifically, index values are down 3.3% for the quarter but still remain up 3.1% for the year (Core Logic).

Overall this is much better than many expected, we are pleased that there was no “September Cliff” as originally reported and the economic recovery does seem to be encouragingly moving towards a U or V shape. With restrictions starting to lift and private home inspections once again permitted we are expecting to see activity lift in October.

What can we learn from other lockdowns?

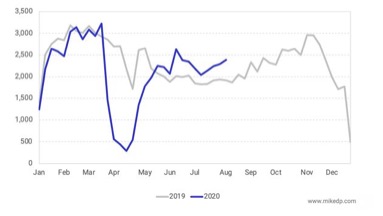

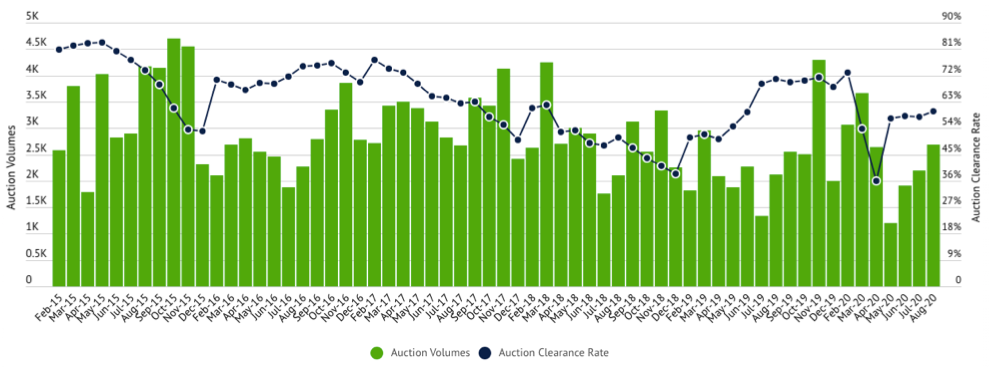

The performance of the Sydney and New Zealand property market gives us a good indication of what we can expect in Melbourne. Over the past month, the Sydney market has rebounded very strongly this week, clearance rates are currently sitting at the 70, 75 percent mark. Similarly looking at New Zealand they experienced a swift recovery following their stage four lockdown. It did not take long for new listings to surge higher than the 2019 level, a natural result of delayed supply from the lockdown.

Since Melbourne is reopening in the midst of the spring selling season and with exceptional pent up demand, we could see an even greater recovery.

New Zealand’s post lockdown listings surge

Sydney Clearance Rates and Auction Volumes remain steady.

If you’re interested in knowing how the market affects your own property, request an updated appraisal here