What’s happening to Melbourne property prices in 2022? Are property prices going to fall in 2022? Or will we see the current growth continue? It’s the age-old bull vs bear argument, but many experts are tipping a cooling property market and falling property prices. In this month’s article, we summarise the main reasons why this may be on the horizon.

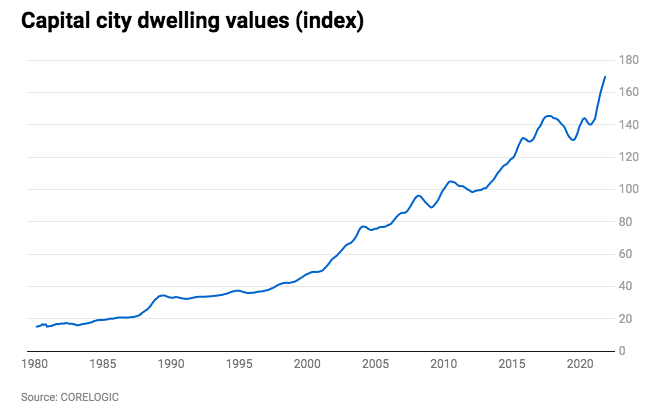

- We’re coming off the fastest annual increase in Australian home prices in 30 years.

- After a 22% rise in 2021. Banks and economists expect house prices to slow to 5% growth in 2022 and to fall 5-10% in 2023.

- The main drivers behind the slowdown are worsening affordability; rising supply; rising rates; macro-prudential tightening; & a rotation in spending away from housing.

- The main risks on the downside are another covid set back or faster rate hikes from the RBA.

- The main factor to the upside would be a quick return to pre-covid immigration.

- While auction clearance rates are still very strong, consistent with a loss of growth momentum, they have fallen around 10-15 percentage points from their October highs in Melbourne, another indication we may be in for a cooling.

Sydney and Melbourne’s prices led the charge over the last decade, and now as you would expect they are suffering from affordability and are likely to come in a bit weaker than average over the next two years. The way I look at it, the last few years have been nothing short of extraordinary where the market truly proved its resilience. Let’s take a moment to reflect on this and take pleasure in the growth we’ve seen whilst perhaps the market takes a necessary pause to refresh.

Frank Callaghan A R E I B Comm Managing Director

- December 2021. Source A N Z, A M P and the AFR.